Money shouldn’t be confusing — it should be empowering 💡

At NM Financial Services, we’re helping young adults build a

strong financial foundation through our Financial Literacy

Program — packed with interactive workshops, real-world

investing insights, and easy-to-understand lessons on wealth

creation.

Join us in building a financially literate future! 💰

Learn. Invest. Grow.

Connect to host a session at your college / your office / our

office.

Note: Each of our sessions is customised based on our

attendees.

We believe that every investor is unique — with different goals, risk tolerance, and financial aspirations.

We focus on understanding your financial journey and recommending investment strategies that align with your life stage, income, and vision for the future.

Proprietor

Admin & Client Management

Client Management

Values

Mission

Vision

At NM Financial Services, we operate on a foundation of core values that guide our interactions and decisions:

To empower individuals to achieve their own definition of success.

To build: “A Financially Aware and Empowered India”.

At NM Financial Services, we wish to

Who are we?

Founded in 2003, we began with a simple mission - to help families achieve Financial Freedom with clarity, discipline, and proper guidance.

We believe that long-term wealth is built through:

Today, we have touched 600+ families, empowering each to build a secure, peaceful, and financially strong future.

What are our services?

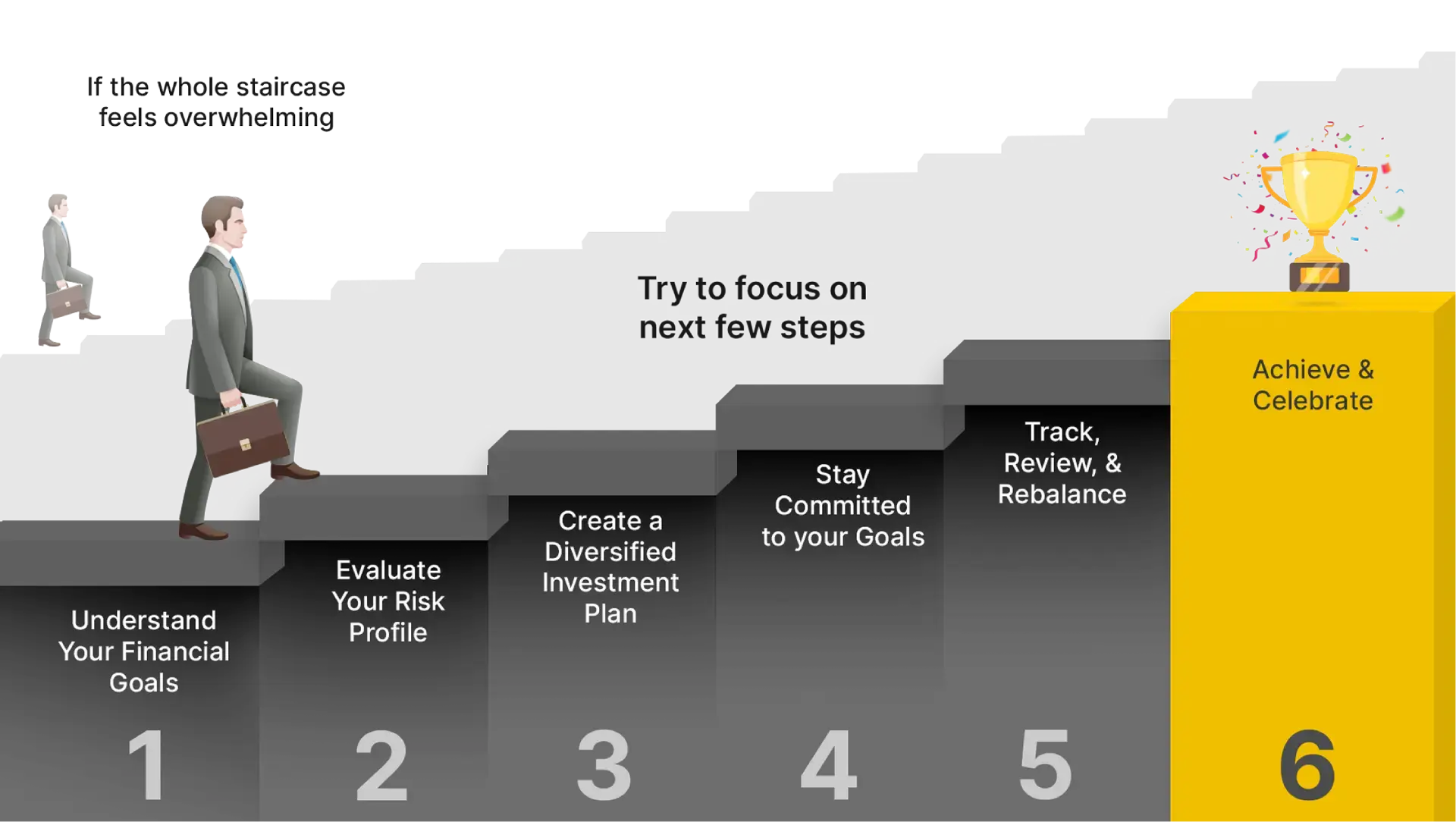

“Life without Plans is like a Taxi without Wheels. You are not going anywhere.” We believe in Goal-Planning-based-Investing. Hence, we provide service for every step:

Whom do you cater to?

We cater to a wide range of clients, including:

We serve clients across all income levels and backgrounds — anyone who intends to grow and manage their wealth wisely.

Do you provide services outside Mumbai or remotely?

Yes, we provide services across India and globally. Whether you're in our city or we’re in yours, we’re happy to meet in person. We also offer remote assistance via calls, video meetings, and email, ensuring convenience no matter where you are.

But we would love to meet if you are in Mumbai or we are in your city.

How do I start investing through you?

It’s easy to begin your investment journey with us. Just follow these 4 simple steps:

We’ll guide you through the entire process to ensure clarity and comfort at every step.

How can I contact you?

You can reach us via:

📧 Email 📞 Phone Call 💬 WhatsApp

Our team will get in touch with you promptly to understand your needs and provide further assistance.

Do it Yourself (DIY) vs. Do through Professional (DTP)?

Any activity requires specific skills & knowledge to perform. The same applies to money management. If you're able to give your time and effort to learn about it, you can go for a DIY approach. Alternatively, 'Do through professional (DTP)' is always a better option, allowing you to focus on your work/life, and also minimise mistakes along the way.

Why should you work with a Personal Finance Professional or a Mutual Fund Distributor?

We aim to simplify your investment journey by acting as your trusted financial personnel — someone who helps you make informed, confident, and goal-oriented money decisions with consistent guidance, especially during turbulent times.

Our Role:

Working with a professional helps you save time, avoid costly mistakes, and bring structure and clarity to your finances — especially when life gets busy or the market turns volatile.

Do you provide stock tips or invest in stocks?

No, we do not invest in direct equity, nor do we offer any stock tips.

We believe in long-term, goal-based investing through mutual funds. Following daily stock movements can cause distraction and emotional decisions — which may hurt your financial goals in the long run.

Some Do's & Don'ts while working with us?

What are the common mistakes that can be avoided?

Common financial mistakes include:

Do we have to transfer money to NM Financial Services’ account to start investing?

Absolutely not. All mutual fund investments are made directly from your bank account to the pooled accounts of NSE or MF Utility, which then route the funds to the respective Mutual Fund Houses. NM Financial Services never handles or receives your money. We help you initiate and execute the transactions smoothly and securely.

How do you charge clients? What is your fee structure?

We do not charge any separate or direct fees to clients.

As AMFI-registered mutual fund distributors, we are compensated by Asset Management Companies (AMCs) through commissions on investments in the Regular Plan. This enables us to offer our services at no additional cost to you.

What is the difference between Direct Plan and Regular Plan?

The main difference is that direct plans are bought without an intermediary, leading to a lower expense ratio, while regular plans are invested through a distributor or advisor, have a higher expense ratio because it includes commission, and offer professional advice. Both plans are managed by the same fund manager and invest in the same underlying portfolio, with the primary difference being the method of investment and the associated costs.

| Features | Direct Plan | Regular Plan |

|---|---|---|

| Investment Method | Directly through the Asset Management Company (AMC) | Through a mutual fund distributor, bank, or other intermediary |

| Expense Ratio & Fees | Lower, as no intermediary or commission is involved | Slightly higher, as it includes distributor commissions |

| Returns | Potentially higher due to lower costs | Slightly lower due to higher expenses |

| Advice & Guidance | Investor makes decisions independently | Professional advice is provided by the distributor |

| Suitability | For financially aware and digitally comfortable individuals who have independent decision-making skills | Ideal for beginners, busy professionals, those seeking ongoing suggestions, hand-holding, and monitoring of portfolios |

Can you invest in Direct Plans and charge fees on them?

No, we cannot invest through Direct Plans or charge fees on them.

If you wish to invest in Direct Plans, you can either:

As a Mutual Fund Distributor, we can only facilitate investments under Regular Plans, where we are compensated by the AMC — at an ‘inbuild’ cost to you in the expense ratio.

I am already investing through another MFD. Can you review my portfolio?

We believe in building long-term relationships, not just chasing short-term returns.

If you’re satisfied with your current MFD, we encourage you to continue your relationship with them — consistency is key to achieving long-term financial goals.

However, if you’re unhappy with the service or feel your portfolio isn’t aligned with your needs, we’d be happy to have a conversation to understand your situation better before establishing a new relationship.

We also don’t recommend working with multiple advisors, as it can create confusion, overlapping strategies, and misaligned goals — often leading to poor outcomes.

Our goal is always to ensure your peace of mind and clarity in your financial journey.

How do you execute the transaction on my behalf?

We only initiate and send the transaction link on your behalf. The transaction is executed only after you authorize it and complete it through OTP verification via your registered email and mobile number.

The link, sent directly by NSE, MFU, CAMS, or KFintech platforms, which will include all details — investor name, scheme, amount, payment method, bank info, and a Transaction Reference Number (TRN) or Group Order Number (GORN).

You’ll receive confirmation or rejection via email/SMS from the Mutual Fund, NSE, or MFU platform. Once processed, a mutual fund statement will also be sent to you for your records.

Do you invest through Demats?

No. We invest in non-demat format through channel partners (MF Utility & NSE) and RTAs (CAMS and KFintech).

Would you suggest shifting a portfolio from the Direct Plan to the Regular Plan or vice versa?

We generally do not recommend switching between Direct and Regular plans, as this triggers capital gains tax due to the change in NAV between plans.

Shifts should only be considered in specific cases — such as a genuine need, suitability concerns, or non-performance of a particular theme or fund.

Our focus is to help you make decisions that protect your long-term wealth, not create unnecessary tax implications.

Can you share the portfolio of your existing clients?

We’re committed to protecting our clients’ privacy and confidentiality, so we don’t share individual portfolios.

However, we’re happy to discuss example strategies or typical portfolio structures that align with different goals, risk levels, and time horizons. Every investor is unique, and so is their portfolio.

How do you select funds?

We follow a disciplined, research-driven process to select funds.

Our selection is based on key factors like fund performance consistency, fund manager track record, risk-adjusted returns and investment style.

In short, we don’t chase short-term returns — we choose funds that align with long-term wealth creation.

Will you suggest schemes that give you higher commissions or help you achieve sales targets, like banks do?

No, we do not have any sales targets. Sales-driven goals often lead to misguidance and mis-selling, which ultimately create dissatisfaction for investors — we strictly avoid this.

At NM Financial Services, we believe in building long-term, trust-based relationships.

Just like a doctor prescribes treatment based on a patient’s needs, we recommend investment products based on your financial goals, risk profile, and suitability — not on commissions.

Our success lies in your financial well-being.

How do you know which fund is best suited for me?

We recommend funds that align with your profile — your financial goals, investment horizon, risk tolerance, and liquidity needs, not just what's performing well at the moment. It’s about suitability, not popularity.

Our goal is to match the right fund to the right investor — so your investment journey stays on track.

Could you review my existing portfolio and provide guidance?

We offer this only to our prospects.

When we design a new portfolio for you, we do take into consideration your existing mutual fund holdings — to ensure proper alignment, diversification, and to avoid duplication of schemes.

Our goal is to help you build a balanced, goal-oriented investment strategy going forward.

What is the expected portfolio return?

That's a fair question — but perhaps not the right one.

Rather than predicting returns, we help you build the right investor behaviour — to stay invested with discipline and patience, aligning your portfolio with your goals, risk tolerance, and investment horizon.

We don’t promise specific returns, as Markets are beyond anyone’s control, but how you respond to them — that's where the real value lies.

We help you commit to time investment over rate investment. Because, in the long run, it's not about timing the market — it's about time in the market.

How often do you review the portfolio?

We conduct a comprehensive portfolio review every six months and ensure that you receive at least one annual call, regardless of your portfolio performance.

We recommend changes only when required or if your goals or financial situation have changed. We believe in maintaining a focused, long-term approach, i.e., not unnecessary churning.

How can I track my portfolio?

You can easily track your portfolio in the following ways:

🔒 Note: We do not share portfolio information with any unauthorized person unless we receive explicit communication from the account holder.

How often do you review whether the best-performing funds are in my portfolio?

We continuously monitor all recommended mutual fund schemes and their performance against benchmarks and category peers, consistency and suitability.

A detailed portfolio review is typically conducted every 6 to 12 months, or earlier if there are significant market changes, a shift in fund strategy, or updates in your financial goals.

Our focus is not just on chasing the “best performers”, but on ensuring your portfolio remains balanced, aligned with your goals, and positioned for long-term growth.

What is Ravivaar ki Paathshala? Where do you conduct it?

Ravivaar ki Paathshala is our unique Financial Literacy initiative, where we host small-group sessions (4–6 individuals) with individuals of similar ages.

These sessions are usually conducted:

We also conduct Investor Awareness Programs (IAPs) for a larger audience size as part of our commitment to financial education.

What topics do we cover in Ravivaar ki Paathshala?

Our sessions make finance simple, practical, and engaging — covering topics such as:

Each session is customised for the audience — whether students, professionals, or families — ensuring relevant, actionable financial insights every time.